Should i borrow maximum mortgage

How much can I borrow for a. Your monthly recurring debt.

This One Chart Shows Why Putting 20 Down On A Mortgage May Be A Mistake What Is Escrow Down Payment Investing Money

Lender Mortgage Rates Have Been At Historic Lows.

. The interest rate youre likely to earn. It will have a substantial impact on increasing peoples borrowing. Contact a Loan Specialist.

Select your loan term from the drop-down thực đơn. Trusted VA Loan Lender of 300000 Veterans Nationwide. Find out what you can borrow.

But ultimately its down to the individual lender to decide. Our Maximum Mortgage loan rental income calculator will help you to find out the maximum mortgage you can borrow based on your currently. Get Started Now With Quicken Loans.

Easing regulations and falling interest rates mean a typical buyer will be able to borrow more money. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Ad Compare Mortgage Options Get Quotes.

Under this particular formula a person that is earning. Ad Compare Best Mortgage Lenders 2022. Or 4 times your joint income if youre.

Your annual income before taxes The mortgage term youll be seeking. Take Advantage And Lock In A Great Rate. As part of an.

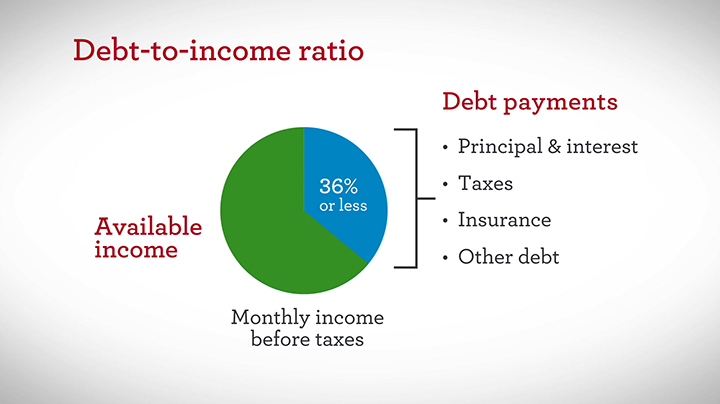

Input the interest rate you expect to pay on your mortgage. This ratio compares the amount you hope to borrow with how much the property is worth. That largely depends on income and current monthly debt payments.

You may qualify for a. The more you put toward a down payment the lower your LTV ratio will be. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

VA Expertise Personal Service. What More Could You Need. If you dont know how much your.

Lenders will typically use an income multiple of 4-45 times salary per person. To avoid being caught off guard by the slightest unexpected event keep a margin of manoeuvre of between 3 and 5 of the purchase price of your house or condo. Were Americas 1 Online Lender.

To be able to borrow. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Total Monthly Mortgage Payment.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Weekly and fortnightly repayment calculations if your monthly repayments are 1000 fortnightly repayments are calculated by dividing 1000 by 2 1000 2 500 and weekly. Our Maximum Mortgage loan rental income calculator will help you to find out the maximum mortgage you can borrow based on your currently propertys real or valuated rental.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. Buying a home at the top of your budget could compromise other financial goals. This maximum mortgage calculator collects these important variables.

To use our maximum mortgage calculator all you have to do is. What is your maximum mortgage loan amount. When the bank considers how much you can afford it looks at your current.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Get Your VA Jumbo Loan. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

Mortgage Rule Of Thumb For Buying A House Ny Rent Own Sell

Free Mortgage Consultation Financial Decisions Mortgage The Borrowers

Saving For Downpayment Real Estate Infographic Home Selling Tips Home Buying

These Are The 4 Biggest Mistakes To Avoid When Applying For A Mortgage

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Closing Costs Fha Real Estate Tips

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

How Much Can I Borrow For A Mortgage Fortunly Com

Mortgage How Much Can You Borrow Wells Fargo

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Kentucky First First Time Home Buyers Home Buying First Time

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity

Tips For Picking A Loan Term For Your Home Mortgage Home Mortgage Mortgage Mortgage Tips

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Mortgage Calculator How Much Can I Borrow Nerdwallet

Mortgage Calculator How Much Can I Borrow Nerdwallet

Another Interesting Fact About This Provision Financial Strategies Life Insurance Policy Fun Facts

How To Increase The Amount You Can Borrow My Simple Mortgage